What is Encumbrance? Definition and Its Role in Business Finance

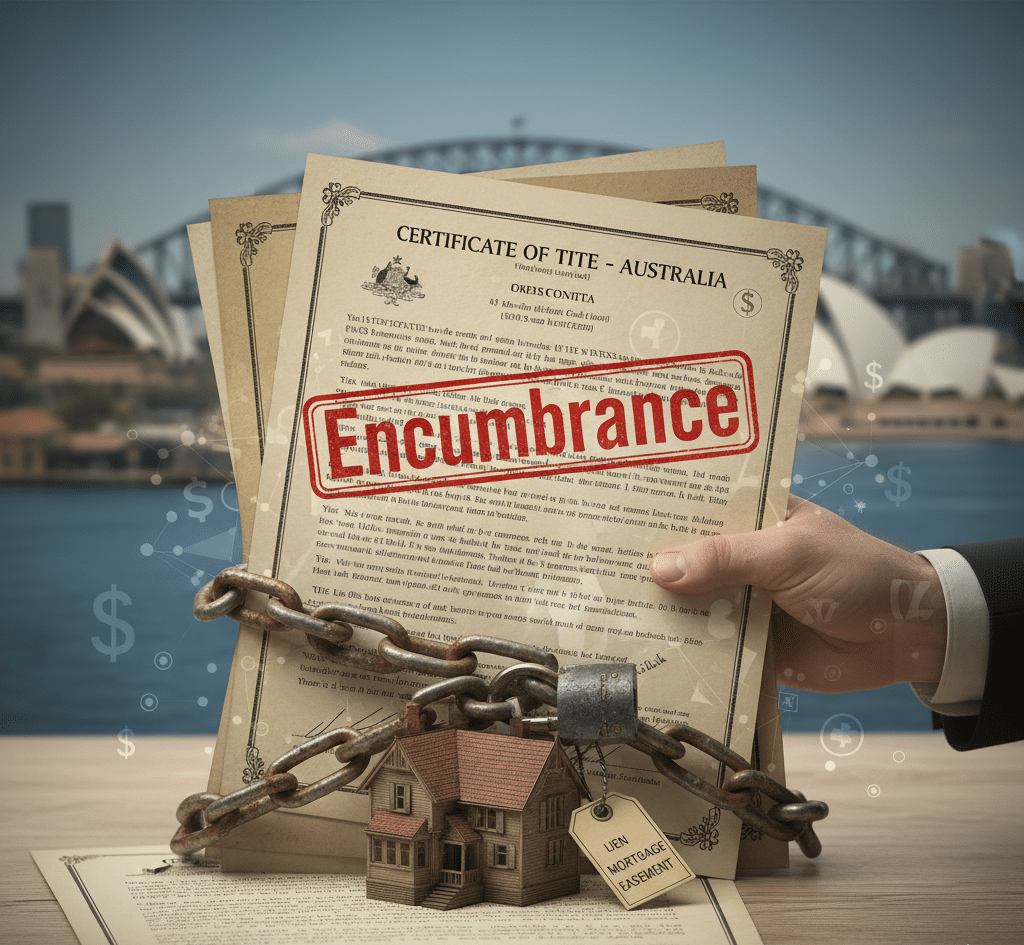

When business owners or property investors in Australia apply for financing, one word often arises during the due diligence process: encumbrance. The term may sound technical, but anyone dealing with assets, loans or property transactions needs to understand it and its role in business finance.

In simple terms, an encumbrance is a claim, lien, or legal liability attached to an asset, most often a property, that can restrict its use or transfer. For businesses, encumbrances can directly influence financing decisions, valuations, and even the ability to secure new loans.

Encumbrance Meaning in Business Finance

The encumbrance definition is straightforward: it is any right or claim that another party has over a property or asset that limits the true owner’s ability to use it freely. While the term is often associated with real estate, encumbrances can also apply to equipment, vehicles, or even intellectual property used as collateral.

For instance:

- A bank may place an encumbrance on a property until the mortgage is fully paid.

- A supplier might register a security interest over business equipment until invoices are settled.

In short, an encumbrance provides security to creditors while placing certain limitations on asset owners.

Types of Encumbrance on Property

To better understand encumbrances on property, it helps to look at common categories:

1. Liens

- A lien is a legal right granted by a lender or creditor to secure repayment. For example, a business loan backed by real estate will carry a lien until the loan is repaid.

2. Mortgages

- This is the most familiar type of encumbrance, where a bank retains an interest in property until the mortgage terms are fulfilled.

3. Easements

- These allow another party (like a utility provider) to use part of a property for a specific purpose, such as laying pipes or electrical lines.

4. Restrictive Covenants

- These are conditions imposed on property use, for example, restrictions on commercial development in certain zones.

Each of these limits how an asset can be used, sold, or leveraged in financing arrangements.

Why Encumbrance Matters for Business Owners

For entrepreneurs and companies, knowing the encumbrance meaning goes beyond legal jargon—it impacts real-world financial decisions:

- Access to Loans: Banks and financial brokers review encumbrances before approving new credit. A heavily encumbered property may reduce borrowing capacity.

- Business Valuations: An encumbered asset is generally less valuable than one without claims, affecting overall balance sheet strength.

- Risk Management: Understanding encumbrances helps business leaders avoid unexpected liabilities during acquisitions or expansions.

Efficient Capital, for example, ensures clients are aware of existing encumbrances before structuring business loans or equipment finance packages, helping avoid funding delays.

Encumbrance and Property Transactions in Australia

In the Australian context, encumbrances are closely tied to property law and financial regulation. Before settlement, property buyers conduct title searches to reveal any existing claims. This is critical because:

- A mortgage registered on the title remains until it is discharged.

- Easements or covenants can limit redevelopment potential.

- Unpaid council rates may create a statutory encumbrance.

Failing to investigate encumbrance can lead to unexpected financial burdens or even legal disputes after purchase.

Managing Encumbrance in Business Finance

If your business is considering expansion or refinancing, here’s how to manage the risks associated with encumbrances:

- Conduct Due Diligence: Always perform title and asset searches before finalising transactions.

- Work with Financial Brokers: Financial brokers can navigate lending requirements and identify potential red flags.

- Prioritise Loan Repayments: Clearing existing debts helps reduce encumbrance, freeing up assets for future funding.

- Seek Legal Advice: Complex encumbrance, such as layered covenants, may require professional interpretation.

By addressing encumbrances early, businesses can secure smoother approvals for working capital loans and avoid costly surprises.

Key Takeaways

- An encumbrance is a claim, lien, or legal restriction on an asset that limits its free use.

- Encumbrances on property include liens, mortgages, easements, and covenants.

- In business finance, encumbrances affect valuations, loan eligibility, and overall financial planning.

- Managing encumbrances requires due diligence, clear repayment strategies, and guidance from professionals.

Conclusion

Understanding the definition of encumbrances is vital for anyone managing property or seeking finance in Australia. Whether you’re a business owner applying for funding or an investor expanding into new property markets, recognising how encumbrances affect asset value and borrowing power will protect your long-term financial health.

Efficient Capital’s team of experienced financial brokers can help identify and navigate encumbrances, ensuring you make informed decisions about business loans, equipment finance, or working capital solutions.