Property Market in Review – 2022 Summary and What’s in Store for 2023

2022 in Review

The property market in Australia performed well in 2022, with steady growth in both house and unit prices in major cities.

In Sydney, the median house price increased by 5.5% year-on-year, reaching $1.2 million. The median unit price has also risen by 4.4%, reaching $814,000. Similarly, in Melbourne, the median house price has risen by 4.1% to $935,000, and the median unit price has increased by 3.7% to $628,000.

In Brisbane, the market also performed well, with the median house price rising by 4.2% to $680,000 and the median unit price increasing by 3.5% to $426,000.

Perth and Adelaide have seen more modest growth, with house prices rising by 2.1% and 2.2% respectively, and unit prices increasing by 2.8% and 2.5% respectively.

Overall, the property market in Australia has been stable and strong, with steady growth in house and unit prices in major cities. However, it’s worth noting that the growth rate of the property market has slowed down as compared to 2021, this can be attributed to various factors like the interest rate, employment rate and inflation.

It’s also worth mentioning that the rental market has also improved, with rental yields trending upwards, providing a good opportunity for investors. The strong demand for rental properties, combined with a shortage of supply, has led to an increase in rental prices.

Efficient Insight – the rise in the property market from the back end of 2020 to 2022 was largely attributable to record low interest rates coupled with high levels of consumer savings coming out of Covid-19. As rates started to rise in 2022 borrowing capacity across the board was impacted and this will drive a slow down in the overall property market, with some pockets experiencing a decrease in the back end of 2023.

Where are we headed for 2023?

Like with interest rates its always hard to make predictions on where the property market will head in 2023. Some economists are already predicting that the median house price in Sydney will fall back below $1 million in the coming months if it hasn’t already.

Coming off record highs in the previous 2 years and with uncertainty surrounding rates still in the market, it is likely that the overall market is due for a decline this year.

As a property purchaser its still important to have a long term view on the market itself and not be blinded by potential short term losses. If you had bought a property in 2020-2022 it is likely you have been able to secure an asset that may not have been possible with todays rates and lending buffers, and likewise if looking at buying now there may be an opportunity get a bargain!

Efficient Tip – Reporting that makes broad statements about the property market is rarely going to be useful for your own personal situation. The property market has many sub markets so if looking to buy follow the data of the local market to make informed decisions.

What other indicators can I look out for?

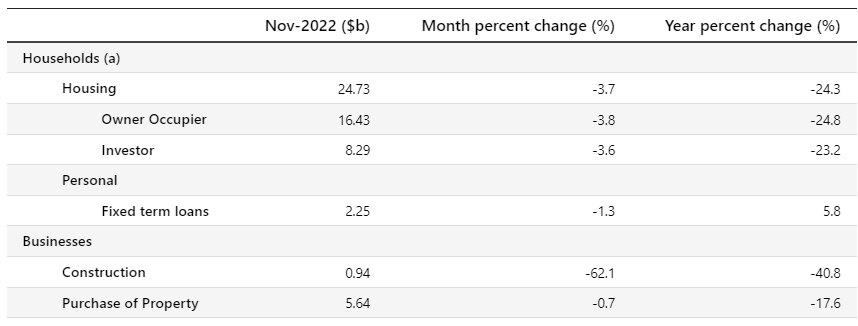

The ABS (Australian Bureau of Statistics) releases data on lending indicators. The data is received by banks and then published by the ABS 2 months later. i.e. the Jan data release covers data from November.

As lending and the state of the property market are linked, this data can provide an insight into what’s ahead. We will report on the trends monthly in these newsletters.

In November the key metrics for the 4 major lending categories all decreased and continued the trend across the prior 10 months of the year.

A deeper look will be taken in the December figures which will be released in Feb.

Summary

We are here to help and part of our service proposition involves helping you to make the best possible property decisions. We can assist with providing property reports, valuations and feedback on potential purchases. Our team have experience in financing and buying properties so can help at every step of the way!

Reach out with any enquiries at info@efficientcapital.com.au or contact your broker

Any advice and information on this website is general only, and has been prepared without taking into account your particular circumstances and needs. Before acting on any advice on this website you should assess or seek advice on whether it is appropriate for your needs, financial situation and investment objectives.