Business Loan vs Overdraft: Which Is Better for Cash Flow?

For the Australian small business owner, cash flow is the lifeblood that keeps the doors open, the staff paid, and the lights on. Yet, as any seasoned entrepreneur in Sydney, Melbourne, or out in the regions will tell you, managing that flow is rarely a linear journey. There are seasons of abundance and droughts of liquidity.

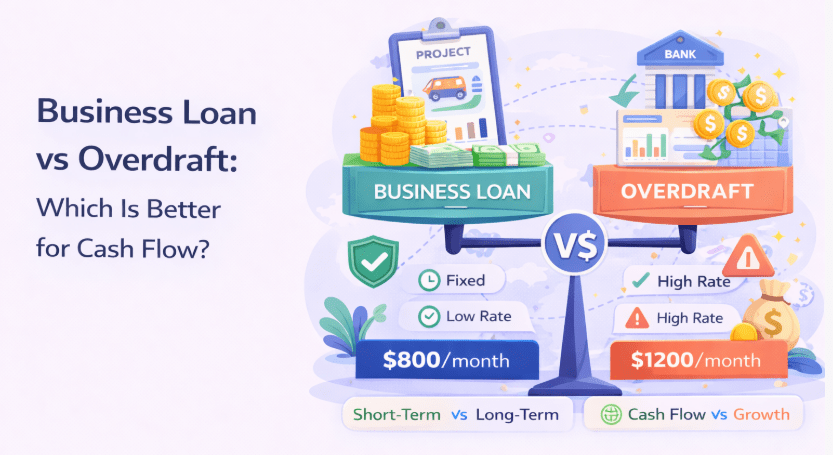

When the bank balance starts to look a little lean, the inevitable question arises: how do we bridge the gap? Most often, the conversation boils down to two heavy hitters in the world of commercial finance. In the debate of Business Loan vs Overdraft, there is no “one-size-fits-all” answer. Instead, the “better” option depends entirely on your specific goals, your current debt appetite, and how you intend to use the funds.

Let’s break down the nuances of cash flow financing to help you determine which path leads to the most sustainable growth for your enterprise.

The Reality of the Australian SME Landscape

Before diving into the mechanics, it is important to understand the context of the current Australian market. According to the SME Growth Index, a staggering 78.2% of SMEs (roughly 8 out of 10 businesses) have faced significant cash flow issues recently.

Interestingly, the way we manage this stress is evolving. Data from the Australian Banking Association (ABA) also shows that 17% of Australian SMEs are now focusing on reducing debt rather than taking on new overdrafts. Furthermore, about 34% of businesses are aiming for internal efficiency gains over traditional borrowing.

However, when efficiency isn’t enough to cover a major equipment purchase or a sudden dip in seasonal revenue, choosing between a business loan and overdraft becomes a critical strategic decision.

Understanding the Business Overdraft: The Safety Net

Think of a business overdraft as a “safety net” attached to your transaction account. It allows you to draw into a negative balance up to a pre-approved limit. You only pay interest on the money you actually use, which makes it a highly flexible tool for day-to-day fluctuations.

The Pros:

- Flexibility: It’s there when you need it and costs nothing (aside from potential line fees) when you don’t.

- Speed: Once established, accessing the funds is instantaneous.

- Interest Savings: You aren’t paying interest on a lump sum sitting idle in your account.

The Cons:

- Variable Rates: Overdrafts typically carry higher interest rates than secured term loans. The current business overdraft rates can range from 12.96% to 15.95% p.a. (with Westpac and ANZ at the respective ends of that scale).

- Uncertainty: Banks often have the right to review or cancel an overdraft facility at short notice.

When conducting a business finance comparison, you’ll find that the overdraft is the king of short-term convenience but can become a “debt trap” if used for long-term expenses.

Understanding the Business Loan: The Growth Engine

A business loan is a more structured animal. You receive a lump sum upfront and repay it over a fixed term (usually 1 to 7 years) with a set interest rate and monthly or fortnightly installments.

The Pros:

- Lower Rates: On average, there is a 2.03% gap between term loans and overdrafts based on RBA data.

- Budgeting Certainty: You know exactly what your repayments are, making long-term forecasting easier.

- Larger Amounts: While overdrafts often cap out around $1M, term loans can go much higher depending on security.

The Cons:

- Inflexibility: You pay interest on the full amount from day one, even if you don’t spend it all immediately.

- Application Process: Usually requires more documentation and a clearer “purpose of loan” than an overdraft.

In the battle of working capital loan vs overdraft, the term loan wins when you are looking to fund a specific project like an office fit-out or a new fleet of vehicles. Especially, where the return on investment is spread over several years.

Analysis: Business Loan vs Overdraft for Cash Flow

When we look at Business Loan vs Overdraft through the lens of cash flow, we have to look at the “Why.”

- Managing “Lumpy” Income

If your business suffers from late-paying clients or seasonal dips, an overdraft is usually the superior choice for cash flow financing. It bridges the gap between paying your suppliers and receiving your accounts receivable.

- Capital Expenditure (CapEx)

If you need to buy a $50,000 piece of machinery, using an overdraft is risky. Because the interest rate is higher, the “cost of money” will eat into your margins. A structured business loan allows you to match the life of the loan to the life of the asset.

- Arrears and Risk

It is worth noting that the Australian market is seeing a slight tightening. APRA’s quarterly statistics show that while total credit is up 6%, non-performing loans sit at about 1.04%. Furthermore, historical data from the Parliament of Australia indicates that in times of economic stress, 90+ day arrears can spike significantly.

This means that whether you choose a business loan or overdraft, having a repayment strategy is paramount. Much like the strategies used to pay off a home loan faster, business owners should aim to pay down their overdraft balance to zero whenever cash flow permits to avoid compounding high-interest costs.

The “Cost of Money” Comparison

To make an informed business finance comparison, you have to look at the data provided by the Reserve Bank of Australia (RBA) and the ABS.

Recent lending indicators show that small business loan rates have historically sat about 105 basis points above the record lows of 2009. While rates have fluctuated, the trend remains: Business Loan vs Overdraft pricing is a trade-off between rate and flexibility.

- Scenario A: You need $20,000 for 10 days to cover payroll while waiting for a major invoice. An overdraft at 15% is cheaper than taking a loan, because you only pay interest for those 10 days.

- Scenario B: You need $100,000 for 3 years to open a second location. A term loan at 8% is significantly cheaper than carrying that balance on an overdraft at 15%.

Key Considerations for Australian Business Owners

When weighing up a working capital loan vs overdraft, ask yourself these four questions:

- What is the primary purpose? Is it for a specific purchase (Loan) or a rainy-day fund (Overdraft)?

- How long do I need the money? Less than 90 days (Overdraft) or more than a year (Loan)?

- What is my collateral? Secured loans (using property or assets) offer the lowest rates, whereas many overdrafts are unsecured but come with a “risk premium” in the interest rate.

- Can I handle the repayments? A loan requires a fixed commitment every month. An overdraft requires discipline to ensure you don’t stay “maxed out.”

According to the ABA SME Lending Report, lending to medium businesses jumped 49% (from $13B to $19.3B) in a single year, suggesting that many businesses are opting for larger, structured loans to fuel significant expansion rather than just “getting by” on credit lines.

The Verdict: Choosing the Right Financial Compass for Your Business

In the end, the choice between a business loan or overdraft isn’t about which product is “better” in a vacuum; it’s about which tool fits the job.

- Use an overdraft for its agility. It is the ultimate tool for cash flow financing when your needs are unpredictable and short-term. It ensures you never miss a payment due to a timing mismatch.

- Use a business loan for its stability. It is the bedrock of long-term planning, providing the capital needed for expansion while keeping your interest costs as low as possible.

At Efficient Capital, we understand that the Australian financial landscape is complex. Whether you are navigating the nuances of Business Loan vs Overdraft facilities or looking for a comprehensive working capital solution, the goal is always the same: to ensure your business has the fuel it needs to reach the next horizon.

Don’t let cash flow be the ceiling on your ambition. By choosing the right financing structure today, you are securing the liquidity you need for tomorrow.